There are various leveraged ETFs. These are stocks with 2 or 3 times the volatility of normal stock movements. Today, let’s learn about LABU, SOXL, and YINN, which are receiving a lot of attention from investors.

- Summary Comparison of LABU, SOXL, and YINN

- Stock Yield of LABU, SOXL, and YINN

- Considerations When Investing in Leveraged ETFs

Summary Comparison of LABU, SOXL, YINN

Here is the key summary information about the three ETFs, LABU, SOXL, and YINN, which are attracting interest from investors. Please check below.

| Category | LABU | SOXL | YINN | Remarks |

| Name | Direxion Daily S&P Biotech Bull 3x Shares | Direxion Daily Semiconductor Bull 3x Shares | Direxion Daily FTSE China Bull 3X Shares | – |

| Management Company | Rafferty Asset Management | Rafferty Asset Management | Rafferty Asset Management | They are managed by the same asset management company. |

| Investment Strategy | Invests in the U.S. biotech industry. | Invests in the U.S. semiconductor industry. | Focuses on investing in large-cap stocks in China. | – |

| Leverage Level | 3 times | 3 times | 3 times | They have a very high level of volatility due to the leverage. |

| Asset Size | 1.3 Billion dollars | 8 Billion dollars | 0.7 Billion dollars | YINN is the smallest. |

| Annual Cost | 1.01% | 0.94% | 1.46% | The cost rate is higher than typical ETFs. |

| Recent 1 Month Return | 20% | 0.60% | -11% | There is a large difference in performance between the ETFs. |

| Dividend Yield | 0.19% | 0.56% | 5.12% | – |

Implications of the Summary

[Product Type] All three ETFs are managed by the same asset management company. Also, there are ETFs that invest in the opposite direction for each product, i.e., they are investment products that invest in market downturns.

- LABD: An ETF that invests in the opposite direction of LABU, betting on a downturn in the biotech industry.

- SOXS: An ETF that invests in the opposite direction of SOXL, betting on a downturn in the semiconductor industry.

- YANG: An ETF that invests in the opposite direction of YINN, betting on a downturn in the stock prices of China’s blue-chip stocks.

[Asset Size] All three ETFs are assets invested for the purpose of short-term high returns, so the asset size is not high. They are of interest to specific investors who invest in high-risk assets.

[Cost] The cost ratio of leverage ETFs is generally higher compared to those that follow the general market index such as SPY, VOO, etc. The annual cost, which is the fee spent, is about 1%, which may not be suitable for long-term investment.

[Dividend] LABU and SOXL are not suitable for investing with the purpose of dividends. YINN appears to have a temporarily high dividend yield rate due to the recent decline in the stock prices of major Chinese companies.

[Stock Return] The purpose of investing in 3x leveraged products is to secure profits from stock price fluctuations. There is a large difference in the recent one-month short-term return rate of the three ETFs. Let’s look at this in more detail below.

Stock Return of LABU, SOXL, YINN

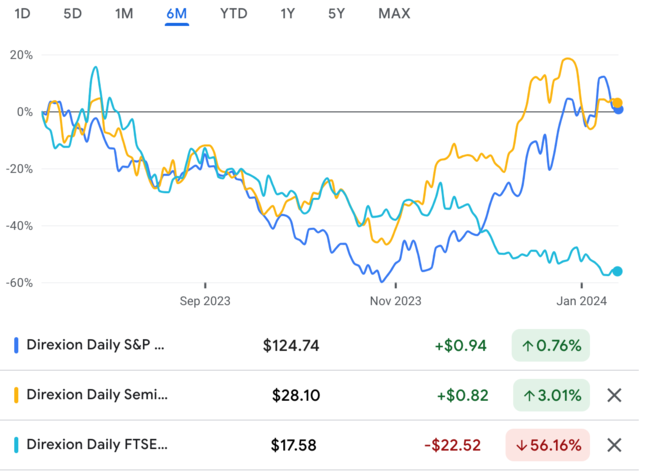

There are people among those considering investing in LABU, SOXL, and YINN who aim for high short-term profits due to the significant drop in the stock prices of these three ETFs.

Let’s check the trend of stock prices for reference.

Last 6 months

Excluding YINN, the stock prices have declined and then increased.

Last 12 months

Only SOXL, which invests in the semiconductor industry, is showing a return of over 100%.

Last 5 years

In long-term investment, SOXL showed a return of over 300%, while LABU and YINN performed very poorly.

Considerations for Leveraged ETF

Investment Understanding the Impact of Leverage

Leveraged products are created by complex financial techniques. They follow a specific index, but their volatility appears differently from market changes.

While it can simply aim for high performance, on the other hand, it can lead to unexpected excessive losses in a short period.

Choice of Investment Direction

Many investors who aim for short-term high returns use leveraged ETFs. Especially in the case of inverse leveraged investments that trade in the opposite direction of the market, more losses may occur than investing in an upward direction.

Understanding the Investment Period

Leveraged ETFs can have volatility faster than expected and may continue to fluctuate depending on market conditions. Especially when investing for a long time, the performance of the stock price may not be good due to the cost and divergence rate of leveraged products.

Leveraged Investment Costs

Leveraged ETFs have a relatively high cost ratio. Depending on the return you expect, it may account for a high proportion, so it needs to be considered.

Disclaimer

- This article is not written to solicit investments.

- The information provided may not be accurate due to differences in the reference period, so investors are advised to verify it themselves.

- The decision and responsibility for investments lie with the individual investor, and the author of this article does not bear any responsibility for the investment results of the readers.

The copyright of this article belongs to seekingtopetf.com.