RealtyIncome, SCHD, VOO, QQQ, and Apple are stocks that investors who invest or consider investing in U.S. stocks may have heard of. Where should one invest if they were to do so? Investors interested in these five U.S. stocks should take a look.

- Comparison Summary of Top Five U.S. Stocks

- Comparative Trend of Price Returns for Top Five U.S. Stocks

- Dividend Comparison of Top Five U.S. Stocks

- Considerations for Investors

Comparison Summary of Top Five U.S. Stocks

Each of the five stocks/ETFs has a different investment character.

- Realtyincome : seeks monthly dividends

- SCHD : balances stock price returns with dividend growth

- VOO : invests in the representative U.S. market index S&P 500

- QQQ : invests in technology/growth stocks

- Apple : being the world’s leading tech stock

In the current stock market, which is likely to be volatile and uncertain in the future, which stock/ETF should one invest in?

Should it be stocks that pay high dividend yields frequently, or those with high price returns? While it depends on individual investment philosophies, it is recommended to first check the facts below.

| Category | Realty Income | SCHD | VOO | QQQ | Apple |

| Type | Individual Company | ETF | ETF | ETF | Individual Company |

| Investment Objective | Real Estate Market Investment, Stable Dividends; Monthly Dividend | Dividend Growth Stocks (Balance of Price Growth + Dividends), Relatively High Dividend Yield | S&P 500 Representative Stock Investment, Stable Growth Investment | NASDAQ Representative Stock Investment, Tech/Growth Stocks Investment | World’s Leading Company, Unmatched Tech Stock |

| Share Price | $57 | $76 | $436 | $409 | $192 |

| Market Cap/Assets size (B) | $41 | $48 | $936 | $220 | $2,994 |

| Dividend Yield | 5.4% | 3.90% | 1.50% | 0.60% | 0.50% |

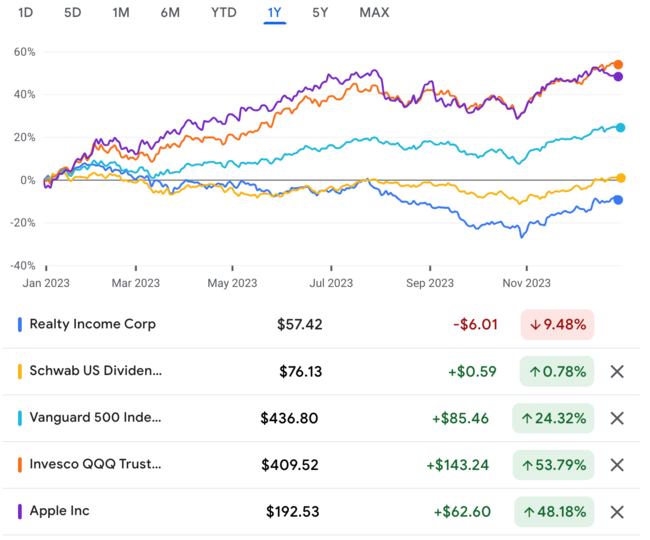

| Recent 1-Year Price Return | -9% | 0.80% | 24% | 54% | 48% |

If you had started investing a year ago, QQQ would have yielded the highest return. However, timing is a critical element in investing.

Whether it’s short-term or long-term investment can also change the outcome. Moreover, the past does not necessarily represent the future.

Let’s proceed by examining the price return trends of these five stocks/ETFs.

Comparative Trend of Price Returns for Top Five U.S. Stocks

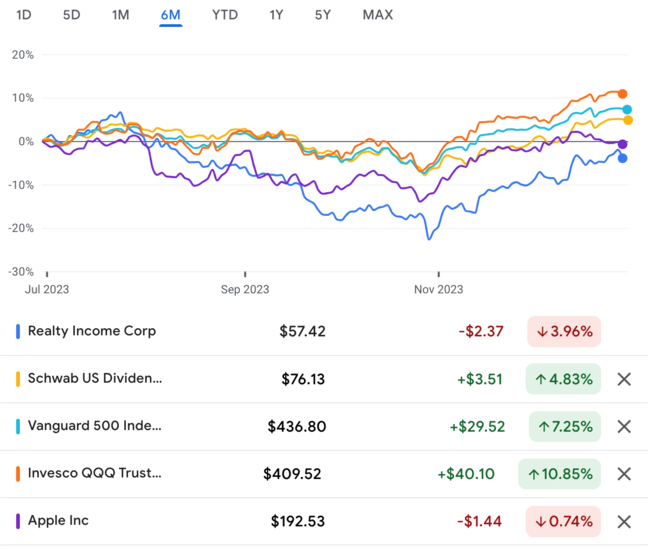

In the last 6 month

The type of stock is distinguished by the color of the line.

Realty Income’s decline has been pronounced. As interest rates rise, the real estate market has contracted, and this appears to have led to a drop in the share price of Realty Income. An increase in interest rates is a negative factor for the real estate market.

but after November Realty Income price has been gone up since the market expect the interest rate drop.

In the last 12 month

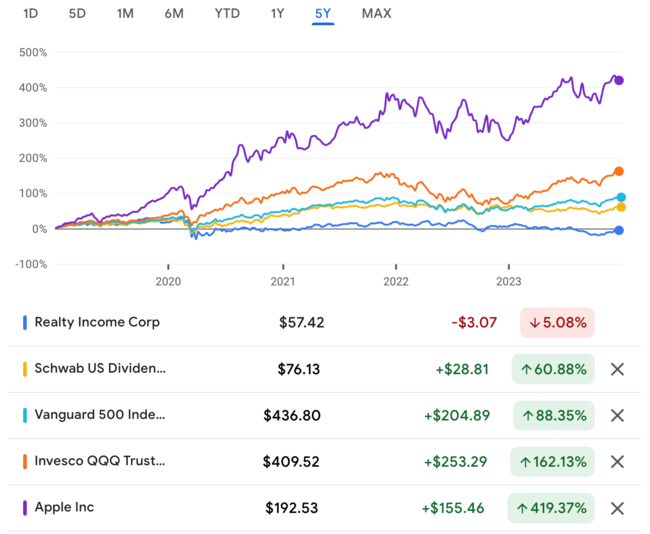

In the last 5 year

If one had invested in Apple and held it for five years, they could have achieved a return of over 400%. On the contrary, Realty Income would have resulted in a -5% return.

Dividend Comparison of Top Five U.S. Stocks

The dividend yields of each stock/ETF are different. Currently, Realty Income, which has seen a drop in share price, offers a 5% yield, while the others range between 1-4%.

SCHD is known as an ETF that invests in companies that consistently increase their dividends. The current dividend yield is around 3.9%.

However, in the long term, it is somewhat questionable whether dividend income will offset the price returns. Of course, investors who desire stable growth and steady dividend increases may judge differently.

For technology stocks like QQQ and Apple, it may be more beneficial to focus on stock price growth rather than dividends.

Considerations for Investors

The five stocks/ETFs are such that U.S. stock/ETF investors have likely considered or heard about at some point. It can be perplexing to decide on an investment.

Realty Income potential Investor:

- May want to invest in real estate.

- May desire to earn a reasonable monthly dividend income (similar to real estate monthly net rental yields).

- May value monthly cash flow over stock price returns.

SCHD potential Investor:

- May seek a balance between price appreciation and dividend income.

- May want to invest in stocks that have a long-term growth in dividend yield.

- May prefer to avoid high volatility in stock price returns.

VOO potential Investor:

- May desire to invest in a market that represents the U.S. and global markets.

- May want to follow the overall market performance with their stock investments.

- May prefer stock price returns over dividends.

QQQ potential Investor:

- May wish to invest in the tech/growth stock market.

- May prefer to invest in the overall market rather than specific tech growth stocks.

- May favor stock price returns over dividends.

Apple potential Investor:

- May want to invest in the world’s leading stock.

- May prefer to invest in a blue-chip tech stock with relatively low volatility.

- May believe they understand the company well.

Investors Considering Past 5 Years of Investment Performance:

- May invest in Apple.

- May choose the NASDAQ market over the S&P.

- While SCHD offers dividend growth resulting in dividend income, it may show similar returns to VOO, making SCHD maybe suitable for investors who manage cash flow/reinvest well; otherwise, VOO may be a better option.

- Besides monthly dividends and a reasonable dividend yield of 4-6%, Realty Income may not present a clear reason for investment (unless one may believe interest rates will decline, in which case some price appreciation can be expected).

Disclaimer

- This article is not written to solicit investments.

- The information provided may not be accurate due to differences in the reference period, so investors are advised to verify it themselves.

- The decision and responsibility for investments lie with the individual investor, and the author of this article does not bear any responsibility for the investment results of the readers.

The copyright of this article belongs to seekingtopetf.com.